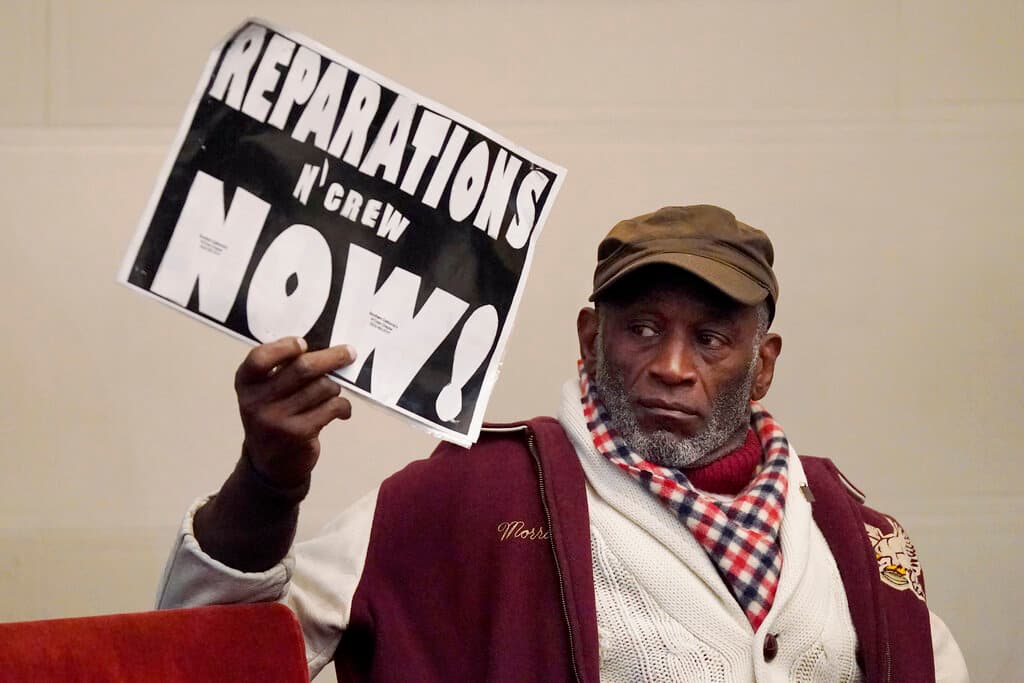

Reparations Payments Could ‘Devastate California,’ Economist Says, Costing Trillions and Causing More Residents To Flee

Little is known about how much the reparations proposals coming out of the California state legislature would cost or where the funding would come from.

As California’s legislature charges ahead with its plans to implement reparations for descendants of slaves in America and those suffering from its legacy, concerns are growing that they could further wreck the fiscally-strained Golden State and accelerate outmigration.

Please check your email.

A verification code has been sent to

Didn't get a code? Click to resend.

To continue reading, please select:

Enter your email to read for FREE

Get 1 FREE article

Join the Sun for a PENNY A DAY

$0.01/day for 60 days

Cancel anytime

100% ad free experience

Unlimited article and commenting access

Full annual dues ($120) billed after 60 days