Norway Has a Message for Democrats Pushing a Wealth Tax

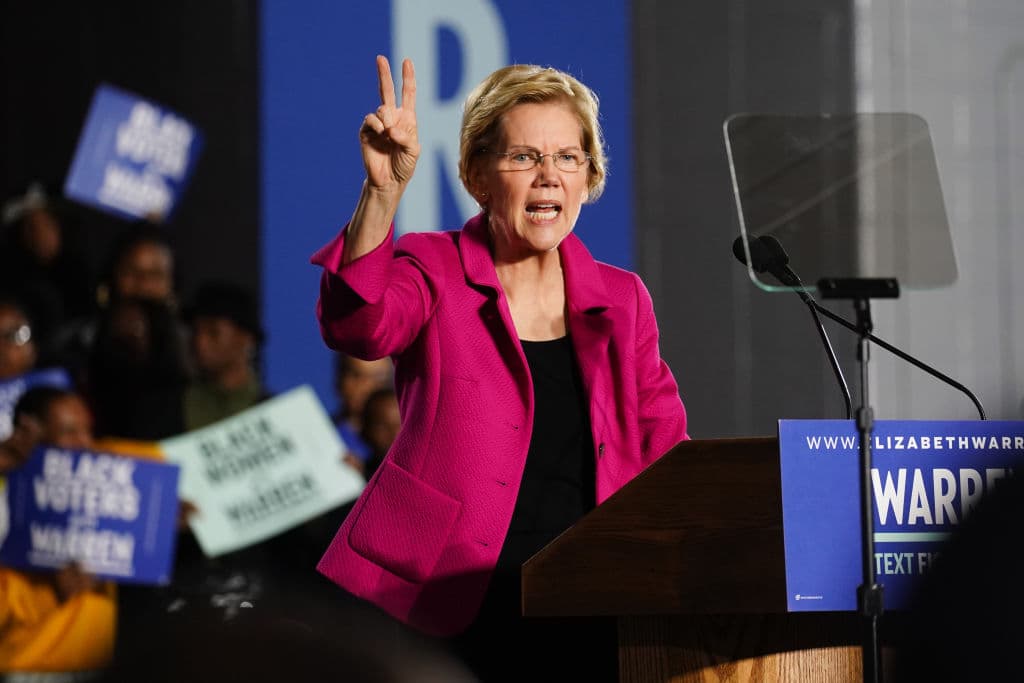

Scandinavian powerhouse tries a wealth tax, and revenues take a turn that undercuts, among others, Elizabeth Warren.

With a higher wealth tax hitting, Norway’s rich are abandoning the Land of the Midnight Sun for countries that allow them to keep more of what they earn, a warning to the Democratic senator from Massachusetts, Elizabeth Warren, as she drums up support for her Ultra-Millionaire’s Tax.

Please check your email.

A verification code has been sent to

Didn't get a code? Click to resend.

To continue reading, please select:

Enter your email to read for FREE

Get 1 FREE article

Join the Sun for a PENNY A DAY

$0.01/day for 60 days

Cancel anytime

100% ad free experience

Unlimited article and commenting access

Full annual dues ($120) billed after 60 days