‘The Pretense of Knowledge’

Fifty years after Bretton Woods, we’re in an inflationary spiral with the Federal Reserve trying to curb demand while Congress spends more money. It’s hard not to wonder whether this is owing to the dollar having been left in the hands of economists.

“ . . . the economists are at this moment called upon to say how to extricate the free world from the serious threat of accelerating inflation which, it must be admitted, has been brought about by policies which the majority of economists recommended and even urged governments to pursue. We have indeed at the moment little cause for pride: as a profession we have made a mess of things.”

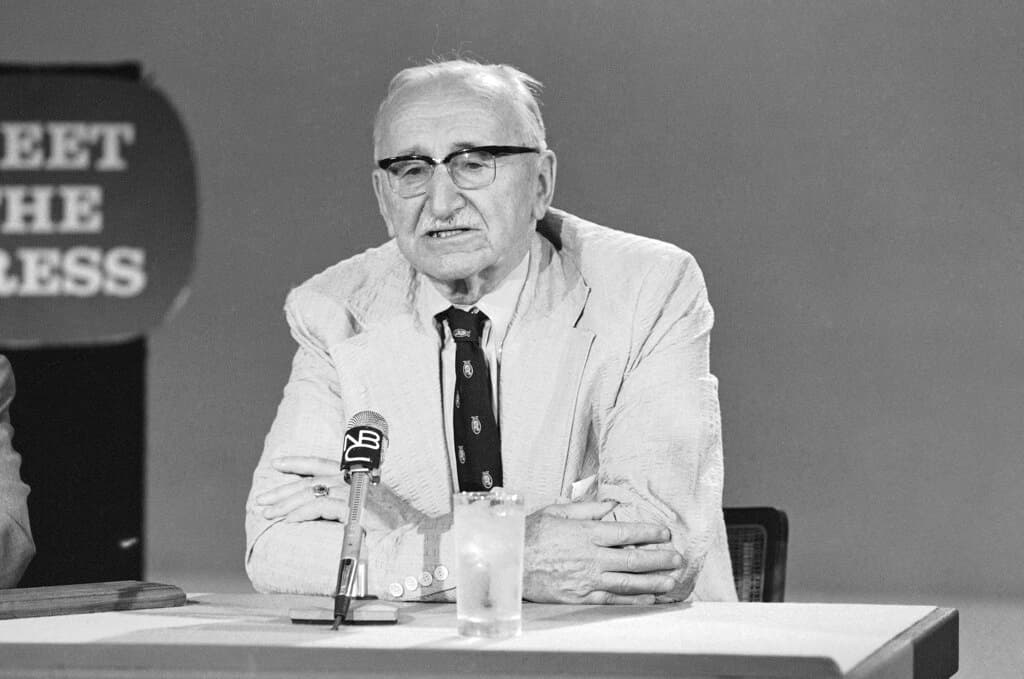

In this season of “unexpected” inflation, one of our shrewdest readers has been calling his friends, reading them the above words, and asking them to guess who spoke them. Our first guess was Paul Volcker. Zwaaaang. Then we tried Milton Friedman. Zwaaaang. It turns out to be — of course — Friedrich Hayek in his Nobel Prize lecture, “The Pretense of Knowledge.”

We should have known. Who else would have had the horsepower to declare, at the height of his own career, that the profession in which he’d risen to glory had made a mess of things? And to respond to the award to him of the Nobel Prize by lecturing the Royal Swedish Academy of Sciences on the folly of economists trying to imitate the procedures of the physical sciences.

What makes Hayek’s remarks so riveting now, though, is how apropos they are for our crisis today. He delivered his Nobel lecture, after all, in 1974. That was in the wake of the collapse of the Bretton Woods Agreement, under which America had undertaken to redeem at a 35th of an ounce of gold dollars presented to it by foreign governments.

Our current crisis could yet prove worse. That’s because with the collapse of Bretton Woods, America moved to fiat money — dollars lacking a definition in law, without backing in gold or silver specie, and yet declared legal tender by legislative fiat. That leaves to the economists at the Federal Reserve an assignment the Constitution vests in Congress — to regulate the value of money.

Hence the mess to which Hayek referred. Fifty years after Bretton Woods, we’re in a new inflationary spiral with the Federal Reserve trying to curb demand while Congress spends more money. It’s hard not to fix responsibility on the dollar having been left in the hands of the economists — a system that the famed editor of the Interest Rate Observer, James Grant, calls the Ph.D. standard.

Under the Ph.D. standard launched in 1971, the dollar has shed nearly 98 percent of its value, having plunged to barely more than a 1,701th of an ounce of gold from a 35th of an ounce. Not only does that not bother the economists and architects of Modern Monetary Theory, but they celebrate it. By 1978, the IMF Treaty was amended to bar countries from defining their money in gold.

It’s not our purpose in this editorial to get into the particulars of Hayek’s critique. We like the way it is underlined, though, in Richard Feynman’s viral video on how hard it is to come to know something — i.e., to promulgate a law. Ironical, too, particularly when these wannabe physical scientists have banned from our monetary system its last element that is physical — gold.

Ex-Fed chief Ben Bernanke in 2010 waved off the risk of his Quantitative Easing. “Well, this fear of inflation, I think is way overstated,” Mr. Bernanke bruited, adding “we could raise interest rates in 15 minutes, if we have to.” Asked in May what went wrong, he mumbled it’s “complicated.” His successor Janet Yellen last year dismissed the stirrings of inflation as “transitory.”

Which brings us back to today’s monetary mess. The last time we had a meal with Hayek he was still on his campaign for a global debate on socialism. Were he alive today, we can imagine him lobbying for a debate on how economists, arrogating to themselves what Hayek called “knowledge which in fact we do not possess,” generated an inflation they failed to foresee and, as yet, are unable to tame.