Letitia James Raises Damages Demands as She Seeks To Ban Trump From Doing Business in New York

‘Virtually every action they took in preparing’ their financial statements, Ms. James’ attorneys allege, ‘was part of a fraudulent scheme.’

New York’s attorney general, Letitia James, is asking the court to fine President Trump, his two adult sons and former employees of the Trump Organization $ 370 million in damages in her civil fraud lawsuit, a steep increase from the $ 250 million she sought in her initial complaint.

“Defendants reaped hundreds of millions of dollars in ill-gotten gains through their unlawful conduct,” state attorneys wrote in a post-trial brief filed on Friday.

The monetary penalty accompanies Ms. James’ additional request to bar Mr. Trump and two of his co-defendants, the former Trump Organization chief financial officer, Allen Weisselberg, and its former controller Jeff McConney, from conducting any sort of business in New York ever again.

In her lawsuit, Ms. James accuses the Trump Organization of fraudulently inflating asset values and Mr. Trump’s personal net worth on statements of financial condition (SFCs) to access better loans and insurance policies.

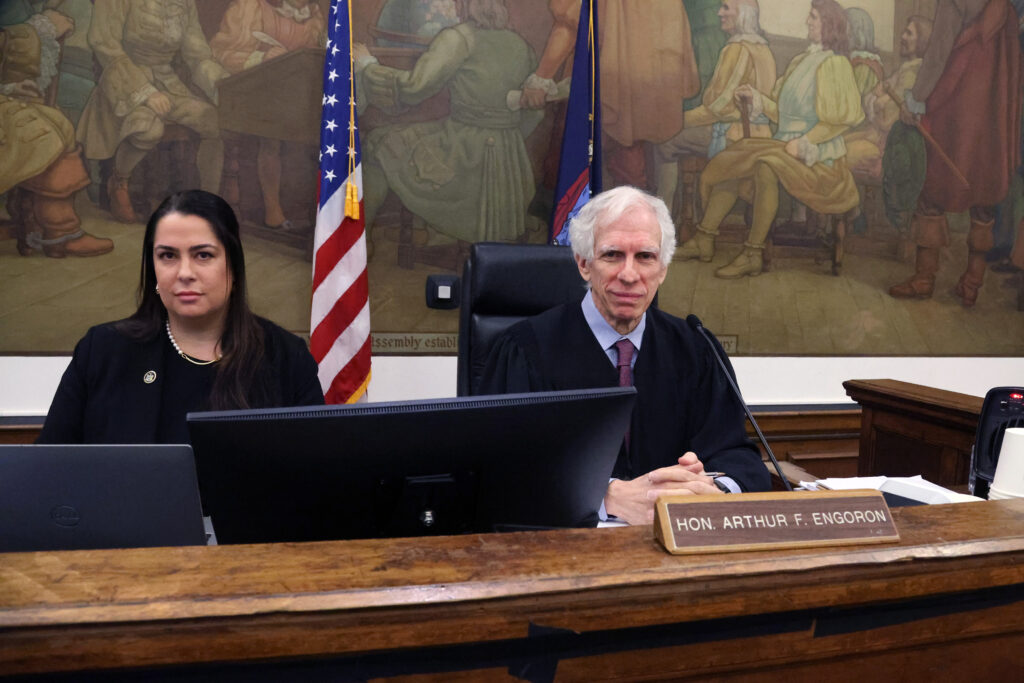

Before the trial began in early October, the presiding judge, Arthur Engoron, found the defendants guilty of fraud. This pre-trial decision, which was based on evidence and arguments submitted by both prosecution and defense, found that “between 2014 and 2021, defendants overvalued the assets . . . between $812 million and $2.2 billion dollars.”

The trial that followed has been to determine the amount of damages the Trumps would have to pay, and also to assess six further claims, such as conspiracy, issuing false financial statements, falsifying business records and insurance fraud.

Over the course of two-and-a-half months, the court heard 43 witnesses, including Mr. Trump and his three oldest children, Donald Jr., Ivanka and Eric. Testimony finished shortly before the winter holidays.

In Friday’s filing, attorneys for the state called the defendants’ intention to defraud “inescapable,” adding that “the myriad of deceptive schemes they employed to inflate asset values and conceal facts were so outrageous that they belie innocent explanation.”

For example, the Trumps allegedly overvalued properties “with onerous legal restrictions – like rent stabilization and conservation easements – as if they could be sold or developed free and clear of such restrictions.” Or they valued “non-existent, yet-to-be-developed buildings as if estimated profits from those buildings could be realized immediately without any present-value discount.”

Ms. James claims that much of the “misconduct occurred on the watch of current co-CEOs Eric Trump and Donald Trump, Jr.,” who took charge of Mr. Trump’s businesses after he became president in 2017. She argues that the two brothers “perpetuated the scheme to inflate the SFCs” and even “certified SFCs.” And yet, she limits their New York business ban to five years.

Meanwhile, their father, the 45th president of the United States, his former chief financial officer, Weisselberg, and his former controller Mr. McConney all face “lifetime injunctions” permanently barring them from ever “serving as an officer or director” of any business again in New York, where Mr. Trump took over his father’s real estate business and became a real estate tycoon and reality television star. “Virtually every action they took in preparing those SFCs,” Ms. James’ attorneys allege, “was part of a fraudulent scheme.”

The defense fired back, asserting that during eleven weeks of trial, “not a single witness has ever testified that either Donald Trump Jr. or Eric Trump had anything more than a peripheral knowledge or involvement in the creation, preparation, or use of any of the Statements of Financial Condition (‘SFCs’) which are at the center of this action.”

Mr. Trump’s oldest son, Don Jr., “relied on CPAs and other accounting professionals in ultimately signing documents relating to the SFCs.”

According to the defense, the attorney general did not demonstrate “any real-world-impact” as none of the lenders were harmed financially by doing business with the Trumps.

Throughout the trial, the defense claimed the judge and his principal law clerk, Allison Greenfield, were biased against Mr. Trump, who was gagged and fined repeatedly for insulting Ms. Greenfield.

Closing arguments are scheduled for next Thursday, January 11. Judge Engoron has said he will issue a ruling in the following weeks. Since this is a bench-trial, and there is no jury, the decision falls on the judge alone.

Judge Engoron already rejected several arguments by Trump attorneys, such as their claim on the statute of limitations and disgorgement, and is not expected to rule favorably for the Trump Organization. The case is expected to be ultimately decided on appeal.