Letitia James Challenges Trump’s Bond Deal With Subprime Car Loan Billionaire, as Defense Slams Her ‘Vindictive Political Crusade’

James says she ‘takes exception’ to the unorthodox bond arrangement, which blocked her from moving to seize Trump’s trophy assets.

New York’s attorney general Letitia James challenged the $175 million bond that President Trump secured to cover the much larger judgment as he appeals the verdict in his New York state civil fraud case. Ms. James is questioning whether the California billionaire Don Hankey, known as “the king of subprime car loans,” is qualified to post the bond for Mr. Trump.

In a court filing on Thursday, Ms. James wrote that her office “takes exception to the sufficiency of the surety,” citing that Mr. Hankey’s company, which provided the bond for Mr. Trump, lacked “a certificate of qualification” required by New York Insurance Law Section 1111. In other words, Ms. James pointed out that the California firm, Knight Specialty Insurance Company, was not registered to issue appeal bonds in New York. She requested that the firm file the appropriate documents to “justify” the bond within 10 days.

Mr. Trump posted the bond earlier this week at the 11th hour, blocking Ms. James from beginning the process of seizing his trophy real estate assets, such as Trump Tower on New York’s Fifth Avenue.

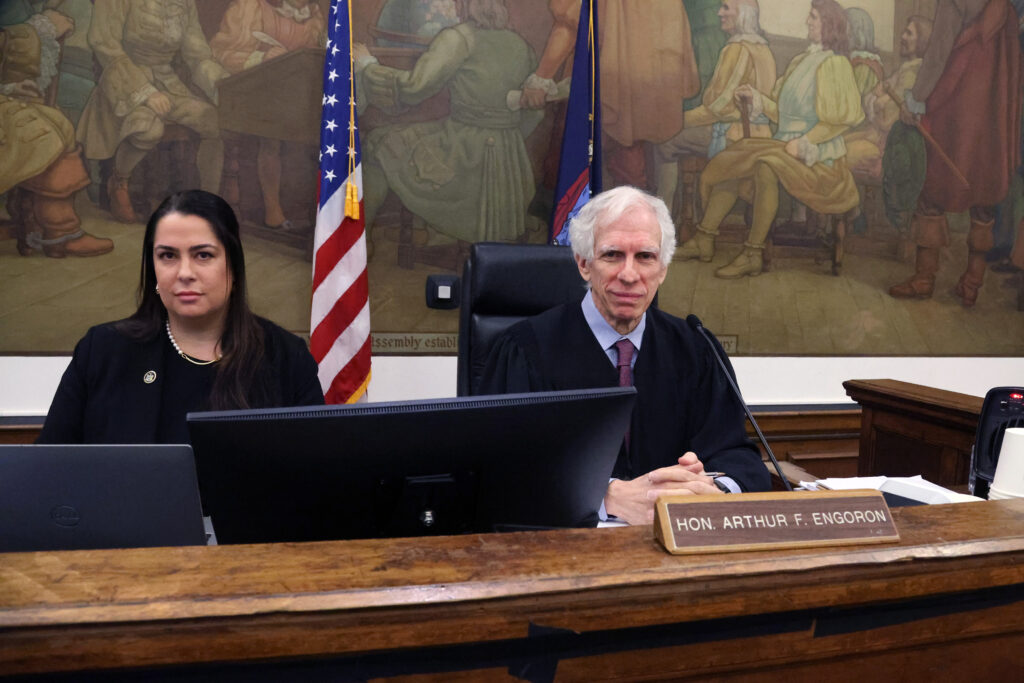

The contretemps over the bond comes about six weeks after a New York State Supreme Court judge, Arthur Engoron, published his written verdict in the civil fraud trial, brought by Ms. James against Mr. Trump and others in the Trump Organization, awarding the state a $464 million judgment.

Ms. James sued Mr. Trump, his two adult sons, two of his former employees — the Trump Organization’s longtime chief financial officer, Allen Weisselberg, and controller, Jeff McConney — and 10 of his companies for business fraud. She alleged that the Trumps falsified business records in a decades-long scheme to gain favorable bank loans and insurance policies.

In order to appeal the verdict, Mr. Trump had to secure a “surety,” a legal agreement, not a money transfer, from a company that will assure New York’s court system that it will cover the judgment against Mr. Trump should he lose his appeal and not pay.

Defense attorneys first asked the state’s intermediate appeals court to reduce the bond from more than $464 million to $100 million. Their request was denied by a single judge. As the deadline to post the massive judgment neared, the defense asked the appeals court again, this time to excuse Mr. Trump from securing the bond entirely. Writing that Mr. Trump had undertaken “diligent efforts” to secure a bond and negotiated with “one of the largest insurance companies in the world,” the attorneys said that “‘obtaining an appeal bond in the full amount of the Judgment is not possible under the circumstances presented.’”

An insurance broker, Gary Giulietti, who testified for Mr. Trump during the two-and-half-months long fraud trial, said in a sworn statement that “a bond of this size is rarely, if ever, seen.” Including the interest, the judgment against Mr. Trump’s reached over half a billion dollars. Judgments of this size usually go only to huge public companies, Mr. Giulietti continued. The Trump Organization is a relatively small, private company that was targeted by Ms. James, an elected Democrat who campaigned on a pledge to go after Mr. Trump.

In a major victory for Mr. Trump last week, a panel of five appellate court judges reduced the bond for the awarded $464-plus million judgment to $175 million. And as the Sun reported, Mr. Trump secured the bond on Monday, underwritten by Knight Specialty Insurance.

Don Hankey has a net worth of $7.4 billion, according to Forbes.

Mr. Hankey told The New York Times that his “motivation was business, not politics.” He said, “I would have done this for Donald Trump. I would have done it for a Democrat.”

The Hankey Group runs eight companies, one of them being Knight Insurance Group. According to the article, “Mr. Hankey earned a reputation as a provider of risky and lucrative loans” to car owners with poor credit.

But Ms. James claims that his company, which has never posted a similar bond before, failed to provide the documents typically included, such as power of attorney for the bond provider, a financial statement from the company and a certificate of qualification from the Department of Financial Services. According to Ms. James, this discrepancy raises concerns that the company won’t be able to meet its obligations, should Mr. Trump lose his appeal and not pay.

If the company fails to “file a motion to justify the surety within ten days of this notice,” Ms. James wrote, “the Bond shall be without effect, except that the surety shall remain liable on the Bond until a new undertaking is given and allowed.”

“In all the years I’ve been doing this,” an attorney, Bruce H. Lederman, told CBS News. “You always have to have a certificate from the Department of Financial Services saying that you’re licensed to issue a surety bond.”

A defense attorney for Mr. Trump, Christopher M. Kise, called Ms. James’s filing “another witch hunt” and accused her office of “hiding out in silence.”

Her case, Mr. Kise said in a statement on Thursday, is “a baseless and vindictive political crusade,” and her complaint an effort “to stir up some equally baseless public quarrel in a desperate effort to regain relevance.”

Judge Engoron has scheduled a tentative hearing for April 22.