Jailed Crypto King Sam Bankman-Fried’s Appeal Protests Same Judge Trump in Carroll Case Denounced as ‘Partisan’ and ‘Out of Control’

The disgraced mogul and the convicted 45th president both have turned their ire on a senior judge who used to represent tobacco giant Phillip Morris.

The appeal to the Second United States Appeals Circuit by the erstwhile crypto king Sam Bankman-Fried throws into sharp relief the possibility of an appellate review of a judge, Lewis Kaplan, who has also drawn President Trump’s invective.

Bankman-Fried was in November convicted in federal court on all seven counts of fraud and money laundering with which he was charged for his stewardship of FTX, a cryptocurrency exchange and hedge fund. He was sentenced to 25 years in prison, and ordered to pay $11 billion in restitution.

A jury of the Southern District of New York brought in those “guilty” verdicts against the 32-year-old erstwhile mogul after a five-week trial and four hours of deliberations. Now, Bankman-Fried wants the riders of the Second Circuit to vacate those convictions on account of what he calls the “unbalanced” approach taken by Judge Kaplan.

The 102-page appeal is unsparing in its taking to task of Judge Kaplan. Bankman-Fried’s lawyers write that their client “was never presumed innocent. He was presumed guilty by the judge who presided over his trial.” The presumption of innocence is a bedrock principle of the due process afforded criminal defendants. Bankman-Fried’s brief alleges that he was hit by a “Sentence first-verdict afterwards tsunami.”

Bankman-Fried contends that Judge Kaplan “repeatedly made biting comments undermining the defense. Even deriding the defendant’s own testimony during the preview hearing and in front of the jury.” Now, the founder wants a new trial before a new judge. Prosecutors persuaded the jury that FTX was $8 billion in the hole. Now, Bankman-Fried argues that “FTX was never insolvent, and in fact had assets worth billions.”

Bankman-Fried, whose parents were until recently tenured professors at Stanford Law School, was convicted after three of his lieutenants, including his girlfriend, Caroline Ellison, reached deals with prosecutors to testify against him. Ellison is due to be sentenced this week. She contends that she ought not to be sent to prison because of her “extraordinary” cooperation with the government’s effort to convict her former boyfriend.

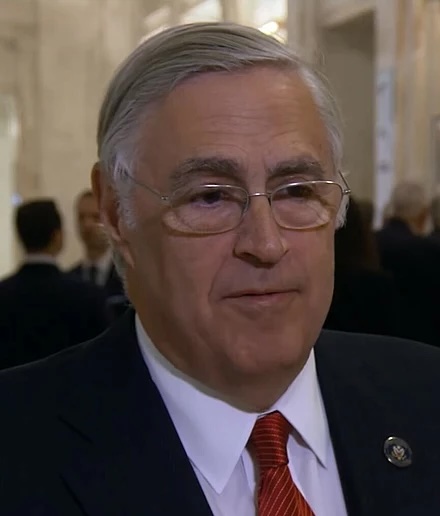

Judge Kaplan, a 79-year-old senior jurist, was named to the bench by President Clinton after years in private practice representing, among other clients, Phillip Morris. He presided over both of Trump’s trials with respect to the writer E. Jean Carroll. In the first, the 45th president was found liable for sexual abuse and defamation. In the second, he was found to have further defamed Ms. Carroll, and ordered to pay more than $83 million.

Trump on Truth Social called Judge Kaplan a “Clinton appointed, highly partisan, Trump Hating Judge” and “one of the most partisan and out of control activists that I have ever appeared before.” The former president also alleged that Judge Kaplan “was a ‘bully’ who demanded two trials, rather than one, denied me Due Process, would not allow me to put forth vital evidence (of which there was much!), and only allowed me to be on the witness stand for minutes.”

Like Bankman-Fried, Trump asked for a new trial, though the 45th president’s request came in the context of a civil and not a criminal trial. Judge Kaplan determined that Trump’s argument was “entirely without merit both as a matter of law and as a matter of fact.” Earlier this month, the Second United States Appeals Circuit heard arguments, with Trump in attendance, over whether the sexual abuse verdict ought to be overturned.

Now, Bankman-Fried hopes that the same appellate tribunal will discern that Judge Kaplan’s handling of his trial was egregious enough to earn him a second one. The judge, Bankamn-Fried alleges, “made little pretense of objectivity or even-handedness” and took to “eviscerating” his defenses in front of the jury. The appeals brief denies fraud and instead notes that in 2022, when FTX imploded, “the stock market declined and crypto markets crashed.” It adds that the “price of bitcoin dropped” more than 50 percent.

Bankman-Fried notes that all of his customers have been made whole. Nevertheless, Judge Kaplan at trial “ridiculed Bankman-Fried’s demeanor” and levied other “inappropriate criticism.” Requests for a new trial, though, are reviewed on a “abuse of discretion” standard that is a demanding one for defendants to meet.