China-Led Economic Group Pushes Forward With Plans To Topple American Dominance

The top two issues during the August 22-24 Brics meeting are a possible expansion of the group and the oft-discussed but mostly elusive idea of creating a denomination, possibly backed by gold.

Can the Beijing-dominated group known as Brics successfully challenge America’s decades-long dominance of the global economy?

In 2001, Goldman Sachs’s chief economist, Jim O’Neill, predicted that as a group Brazil, Russia, India, and China would within a decade surpass the world’s top economies. Next week the group, which was later organized under the acronym Brics, adding South Africa, will meet at Johannesburg for its most-anticipated annual gathering to date.

The top two issues during the August 22-24 meeting are a possible expansion of the group and the oft-discussed but mostly elusive idea of creating a denomination, possibly backed by gold. This would help members and others to bypass what is currently the dominant coin in world trade: the greenback.

The International Monetary Fund, though, could prove to be a roadblock to backing any new currency with gold, as a senior research faculty member at the American Institute for Economic Research, Thomas Hogan, observed in the Sun. That’s because the Second Amendment to the IMF’s articles of agreement “specifically forbids the use of gold as a currency denominator” by member nations.

Meanwhile, as part of Brics, Communist China has created financial institutions to compete with global bodies like the IMF and World Bank, and Beijing’s institutions increasingly dominate lending in countries known as “the global south.” South Africa, which holds the rotating Brics presidency in 2023, is allying with Moscow and Beijing. The rest of the security-challenged continent is following Pretoria’s cue.

Brics’ China-based New Development Bank is “allowed to operate on the international scene equivalent to other international organizations, even though it has only a narrow membership” of the five countries, a former World Bank president, David Malpass, told Bloomberg Television, adding, “I think there has to be a rethinking of the international financial system to give less dominance to Russia and China.”

America “is a world power, and should seek peace through strength,” Mr. Malpass tells the Sun. Yet, Washington seems to eschew rethinking multilateralism. Instead, it actively encourages African countries to associate with Brics, even at the expense of America-dominated institutions like the World Bank and the IMF.

“We have long stood for the proposition that countries should be able to freely associate with other countries in any groupings that they want,” Secretary Blinken told reporters in June, when asked about the upcoming Brics meeting.

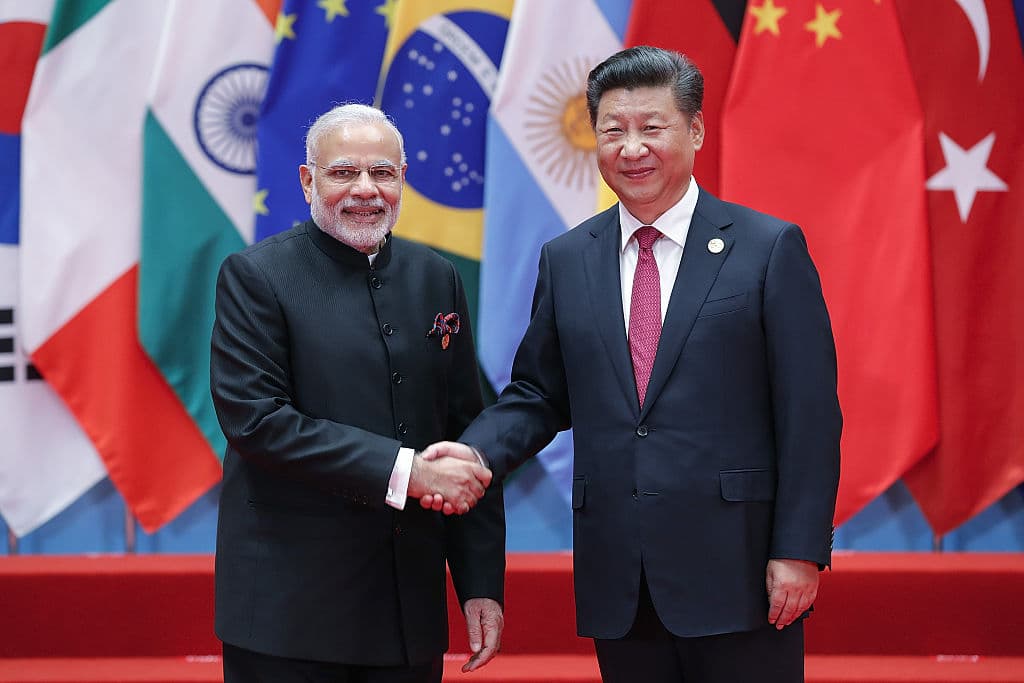

As a group, Brics is far from united politically. India, for one, is a member of the “quad,” which along with America, Australia, and Japan was formed to counter China’s expansionism. This week Chinese and Indian representatives met in an apparently unsuccessful attempt to reduce military tensions on their joint border in the Himalayas.

Although Prime Minister Modi is expected to conduct a bilateral meeting with Chairman Xi next week at Johannesburg, he doesn’t seem likely to turn his back on America or make inroads toward Beijing. Instead, New Delhi sees the Brics summit as a “multilateral forum where India can stake its position, including its concerns over China’s policies,” the executive editor of Hindustan Times, Shishir Gupta, tells the Sun.

Brazil, meanwhile, differs with China over expansion of Brics. To promote his vision of world dominance, Mr. Xi is encouraging countries in Africa, Latin America, and Asia to join the grouping. Brazil is less enthusiastic about further strengthening the group.

Brasilia’s interest in Brics is to counter the power of the so-called global north, a professor of international relations at the Federal University of San Pablo, Regiane Nitsch Bressan, tells the Sun. Yet, she adds, “Brazil knows that if it lowers its guard, China can dominate everything, even Brics.”

Yet, if Brics were to create a common denomination and name it bric, “the dollar’s reign isn’t likely to end overnight — but a bric would begin the slow erosion of its dominance,” a former economic adviser at President Trump’s White House, Joseph Sullivan, writes in a much-perused Foreign Policy piece.

In the immediate future, the dollar is in no serious risk. “You cannot step outside of the dollar universe and operate in a parallel universe,” the New Development Bank’s chief financial officer, Leslie Maasdorp, told Reuters, adding that the NDB’s own operating currency is the dollar because it is “where the largest pools of liquidity are.”

The timing of the Brics summit, moreover, is inopportune for Beijing, as the Chinese economy is yet to recover from Mr. Xi’s disastrous Covid policies, reminding countries of the Chinese economy’s points of weakness. China’s partner in the global drive to weaken America, Russia, is doing even worse: The value of its currency slid Monday, when 100 rubles exchanged for $1 for the first time.

Yet, put together, the Brics’ five members now contribute 31.5 percent of the global gross domestic product. The America-led seven most advanced economies, known as the G-7, contribute only 30.7 percent of the world’s GDP.

America’s economy remains the world’s most reliable and trustworthy. Unless Washington devises new strategies to assert its financial power more forcefully, though, the Beijing-led Brics’ lending institutions seem poised to be able to eventually end the so-called American century.