Biden Quietly Unveils New Student Loan Cancellation Plan Estimated To Cost $121 Billion in Closing Days of the Election

The Education Department’s proposed rule could cancel entire student loan balances if borrowers are deemed to be facing ‘hardships.’

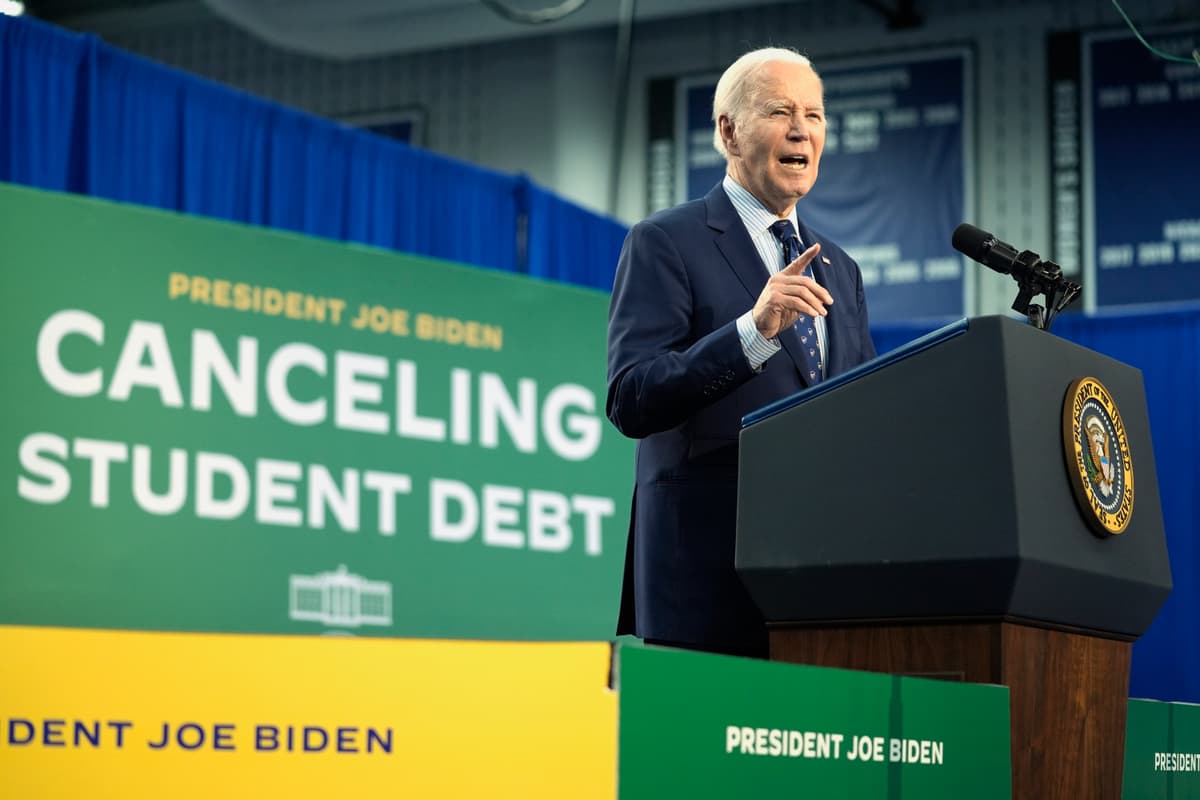

After having the first three efforts blocked by the courts, President Biden’s administration is, in the final days of the election season, quietly unveiling yet another multi-billion student loan cancellation plan.

The Education Department released a proposal on October 31, without much fanfare, that would “specify the secretary’s authority to waive all or part of any student loan debts owed to the department based on the secretary’s determination that a borrower has experienced or is experiencing a hardship related to such loan.”

The public will have 30 days to comment on the proposal, after which the Education Department will weigh whether to amend the rule or finalize it, a process that Forbes notes could drag on until after Inauguration Day.

While there were few details about what constitutes a “hardship” that could lead to a student loan being canceled, the proposed rule maps out two “pathways” for the department to consider.

The first option would not require any action on behalf of the borrower. In this pathway, known as a “predictive assessment,” the Education secretary would have to decide that a borrower’s loans are “at least 80 percent likely to be in default within the next two years.” In that case, the department would “provide immediate relief by granting waivers to eligible borrowers, without requiring any action by those borrowers.”

The other option would be after a “holistic assessment” of a borrower’s “circumstances that meets the proposed hardship standard for [a] waiver” after they apply for review.

“A borrower would be eligible for relief if, based on the Department’s holistic assessment, the Department determines that the borrower is highly likely to be in default or experience similarly severe negative and persistent circumstances, and other options for payment relief would not sufficiently address the borrower’s persistent hardship,” the proposed rule states.

A list of “predictors” provides some examples of what factors would be used to determine whether a borrower is facing a hardship, such as the total outstanding loan amount, the types of loans being held, the repayment plan the borrower is enrolled in, their age, and adjusted gross income. However, the list is described as “non-exhaustive.”

The Education Department says the rule would “create benefits for borrowers by eliminating the hardship they are facing with respect to their loans, allowing them to better afford necessities.”

It estimates the total plan would cost $121 billion, with the automatic cancellations costing $70 billion and the second pathway for relief costing $41 billion.

The latest proposal comes as Mr. Biden’s administration has canceled more than $175 billion in student loan debt, affecting around 5 million people through various debt relief programs.

His previous debt cancellation plan was struck down by the Supreme Court in 2023. It would have canceled up to $20,000 in student loan debt, and it was estimated that the plan would cost $400 billion.

After that ruling, Mr. Biden has bragged that the high court “tried to block me from relieving student debt,” but it “didn’t stop” him.

If the latest rule is finalized and Vice President Harris wins the White House on November 5, the rule is likely to face legal challenges as Mr. Biden’s other student debt plans have. And if President Trump wins the election, it is possible his administration would kill the plan.