As ESG Investments Soften and Pressure Grows on Allegedly ‘Woke’ Finance Giants, Conservative Investment Firms Scour for Missed Opportunities

Non-ESG investors are trying to build a parallel economy that serves an alienated market.

In May, the United Kingdom’s version of the Securities and Exchange Commission will begin enforcing its pledge to crack down on so-called greenwashing by companies wishing to trade on the label of being green-friendly.

The Financial Conduct Authority’s rules, announced in late November, come as U.S. traders await stronger regulations from the SEC. That body moved in September to curb misleading marketing practices by requiring 80 percent of funds that claim to be “sustainable,” “green,” or “socially responsible” to actually be so.

The sustainability disclosure requirements are now deemed a necessity after regulators found “environmental, social, and corporate governance” analysts at Goldman Sachs and Germany’s DWS Group were promoting investments that were not as ESG-friendly as they claimed.

“The portfolio managers weren’t necessarily doing all of the work that they said they were doing,” the associate director of sustainability research for Morningstar Research Services LLC, Alyssa Stankiewicz, said. “They didn’t have documentation or data maybe related to the ESG-ness of these investments.”

At the same time as ESG-friendly firms are facing accusations of insincerity, they’re also coming under pressure from state pension funds in states with Republican-controlled governments that don’t want their employees’ retirement funds affected by what they view as politicized, left-leaning investing strategies.

The ESG space remains enormous.

ESG assets exceeded $40 trillion globally in 2022, according to Bloomberg Professional Services, and 90 percent of S&P 500 companies now provide an annual ESG report. Nearly 75 percent of corporations in the S&P 500 link incentive compensation to ESG measures.

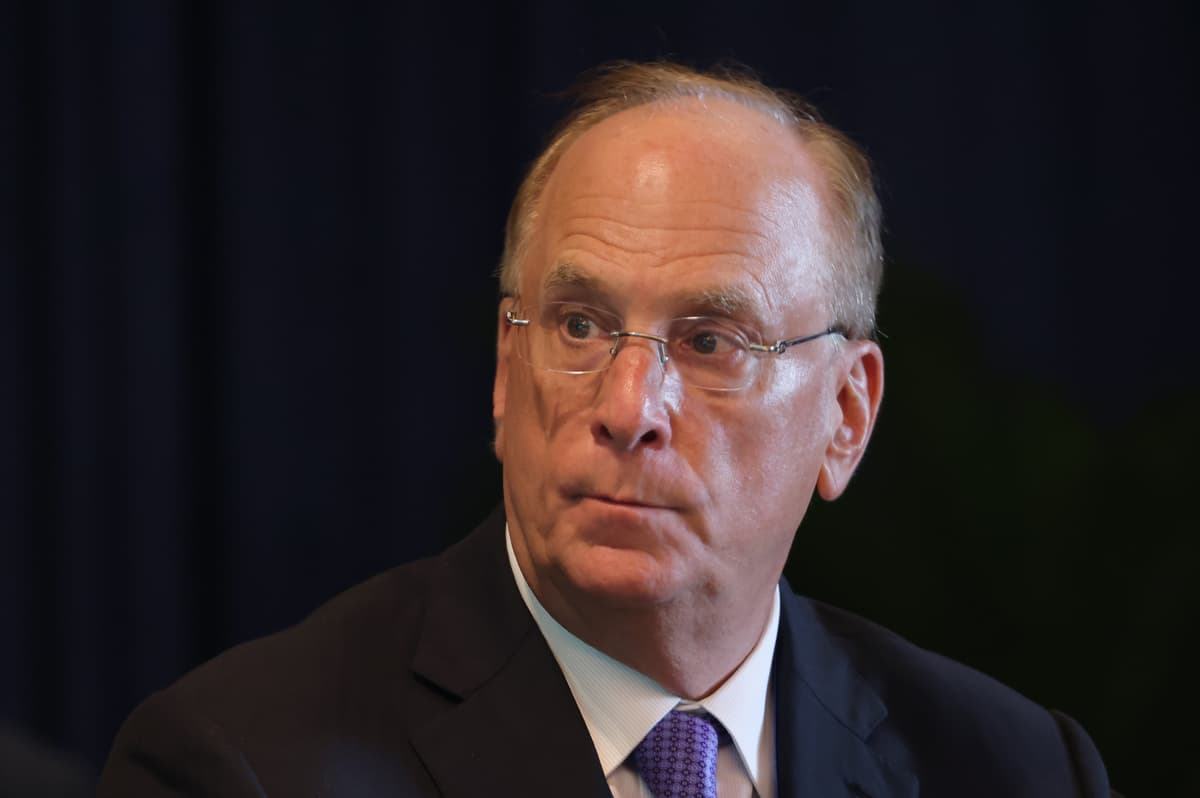

Yet demand for ESG funds fell in 2022 and 2023. iShares ESG Aware MSCI USA shed more than $9 billion this year after BlackRock Inc. alone reduced its allocation in the nation’s second-largest ESG fund by $6 billion. BlackRock has come under increasing pressure from multiple state pension funds concerned that its socially conscious investing does a disservice to shareholders.

In the December Republican presidential primary debate, the company was a centerpiece for complaints about its “woke” agenda by Governor DeSantis and businessman Vivek Ramaswamy. Mr. DeSantis has barred his state’s pension funds fund managers from using ESG factors in their investment process, and pulled $2 billion from BlackRock’s coffers.

Shortly after the debate, BlackRock’s chief executive, Larry Fink, responded in a LinkedIn post that it was a “sad commentary on the state of American politics” that the investment fund was mentioned by some candidates more than inflation or the national debt.

Nonetheless, Ms. Stankiewicz said that weakening demand for ESG investments is in part attributable to companies not living up to what they say they’re doing on the sustainability front, as well as changing macroeconomic conditions, including higher interest rates, concerns of recession, and competing opportunities in the market that are more lucrative than sustainable investing.

“I think there is some general investor concern perhaps with sustainable investing itself, as well as broader market trends,” Ms. Stankiewicz said. “I’m hopeful that part of that will be alleviated by regulatory guidance when it’s finalized to boost investor confidence in the idea that these funds are doing what they say they’re doing.”

Enter EIG — or Entrepreneurship, Innovation, and Growth — firms, which tend to be run by conservative-leaning investors who look askance at what they see as ideological conduct by asset managers such as BlackRock. Managers of these EIG firms — which focus on shareholder value and underserved markets — say opportunities are rife to capitalize regardless of whether the investment opportunities are in vogue.

“When a couple of companies decide that they’re going to be ‘woke,’ that leaves no options for a third, a half, 60 percent of the country that does not want to be talked to that way,” the co-founder and Chief Information Officer of 1789 Capital, Chris Buskirk, said.

Mr. Buskirk said 1789 Capital is focusing on investments that not only increase shareholder value but correct for 50 years of “productivity stagnation” that has pushed extreme wealth to the top while median incomes drop.

“ESG is a politicized investment. It has politicized this mess and it is actually causing tons of malinvestment into things that make the problems that we’ve identified worse,” Mr. Buskirk told the Sun.

Mr. Buskirk said political alienation caused by ESG companies has opened up the market for a parallel economy of sorts that he says is worth about $7 trillion of marketplace GDP.

He offered the examples of the Bud Light and Target boycotts — which came after the companies were accused of virtue-signaling on transgender issues — as opportunities for new businesses to enter the market and create more choices for people who are not getting the products and services they want from the companies they want to do business with.

“Step one is to decrease or minimize the sense of alienation that a part of the country senses,” he said. “By providing choice, there’s an outlet for commercial expression and consumer expression, and I think that actually takes the edge off some of the resentment.”

Mr. Buskirk also pointed to innovative companies that offer different and better products but that may not see the light of day because of ESG mandates. His firm invested in a defense technology company based at Dallas, Firehawk, that developed a solid missile fuel for Stingers and Javelins that he says is 90 percent cheaper to manufacture.

“We have to be ten times better than the competition if we want to move the needle,” he said, noting that investment firms like his can capitalize on defense tech opportunities that ETFs like Vanguard and BlackRock cannot because of ESG mandates that proscribe investments in the military space.

“They’re literally not allowed to invest in that company,” he said. “Here’s just a misallocation of investment dollars based upon a political mandate and it’s holding the country back.”

Strive, founded by Mr. Ramaswamy, is an exchange-traded fund that has been labeled an anti-ESG “activist” investment firm by critics. It excludes public benefit corporations from its portfolios because “by definition they prioritize social goods at the expense of shareholder returns,” a Strive representative told the Sun.

Yet the firm is not in the market to punch back at politically motivated trading per se. “While we frequently call out and attempt to correct value destructive corporate behavior related to the stakeholder capitalism and ESG movement, we don’t pursue an anti-ESG investing strategy,” the representative said.

Strive, which in September exceeded $1 billion in assets, has invested in several firms that promote ESG causes with the goal of effecting change from within. During shareholder votes this year, Strive stood against 60 of 92 executive compensation packages, according to Morningstar. It was on the losing side of 95 percent of these votes.

“They’re voting for resolutions that they think will improve companies’ profitability,” Ms. Stankiewicz said. “Their view on that question is different from a lot of other big actors in the market.”

The Strive representative said the company “pursues unapologetic capitalism” to maximize value for its clients, adding it will “continue to use our voting and engagement to focus companies on shareholder returns.”

1789 Capital does not operate as an “activist” investor. Yet this fall it did drop $15 million on conservative personality Tucker Carlson’s new media startup, suggesting 1789 is looking for a megaphone.

Mr. Carlson “is like the Taylor Swift of media. There’s no bigger name,” Mr. Buskirk said. “Tucker will be the point or the tip of the spear for … a news media company for this generation.”

ESG investing is unlikely to wither anytime soon. Bloomberg predicts ESG-fueled funds will grow to $50 trillion in assets in 2026. 1789 Capital also doesn’t have results to show for itself, as it has only made two investments so far and had its first closing in late September.

Yet Mr. Buskirk said profit is step two to correcting the slide toward stagnation.

“Our system isn’t perfect but it does basically work, and it requires effort and we’re trying to put in the effort to make our system work as well as possible for as many people as possible,” he said.